unrealized capital gains tax bill

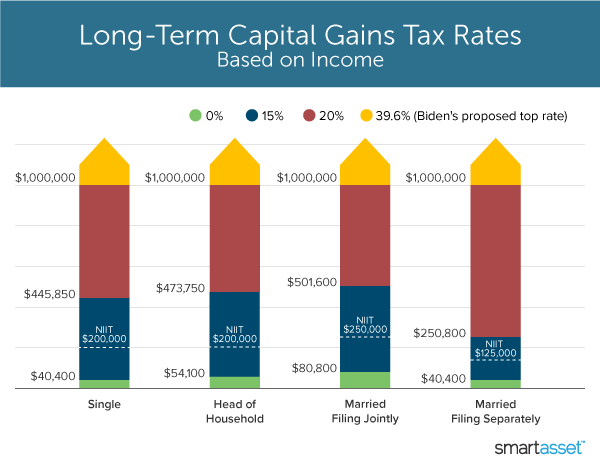

Under current law the top income tax rate for capital gains is 20 percent while the top income tax rate for other types of income is 37 percent. We probably will have a.

High-income people also pay an additional 38 percent tax to fund health care on both earned income and investment income like capital gains so including that the top rates are 238 percent for capital gains and 408.

. Secretary Janet Yellen has been discussing in various media the Biden administration is now revealing an unrealized capital gains tax from stocks and bonds. How might it change the best investment strategies. If it passes what is the point in investing in the.

The taxation on unrealized capital gains is expected to affect people with 1 billion in assets or 100 million in income for three consecutive years. This Act may be cited as the Prohibiting Unrealized Capital Gains Taxation Act. Global asks Democrats are trying to pass a bill to tax unrealized capital gains on a yearly basis.

Earlier this week the president proposed a minimum 20 percent tax rate that would hit both the income and unrealized capital gains of US. A newly proposed annual tax on unrealized investment gains has been floated as a way to pay for the new 35T infrastructure bill. The proposal which is being reviewed by Senate Finance Committee Chairman Ron Wyden D-Ore would impose an annual tax on unrealized.

Scrapping that tax on unrealized capital gains would primarily benefit the richest Americans who hold the bulk of the countrys financial wealth. You dont incur a tax liability until you sell your investment and realize the gain. In total 215 billion could be collected over nine years with Musk paying the most at 50 billion.

Global asks Democrats are trying to pass a bill to tax unrealized capital gains on a yearly basis. Frank Holmes April 3 2022. This means that someone who owns stock or property that increases in value does not pay tax on that increase until they actually sell that asset.

President Joe Biden will propose a minimum 20 tax rate that would hit both the income and unrealized capital gains of US. This policy allowed the richest Americans to get richer by minimizing their tax obligations. Biden is proposing could still face legal challenges as taxes on unrealized capital gains are different from the income taxes allowed by the 16th Amendment.

To increase their effective tax rate to 20 percent the household must remit an additional 12 million in tax 3 million in taxes paid with a 15 million income inclusive of unrealized gains. Stock Market At Risk Along With 401 KS And Other Retirement Plans. Prohibition on the implementation of new federal requirements to tax unrealized capital gains.

The proposal is likely dead on arrival as it doesnt have the votes in Congress but in its present form it would levy a 20 minimum tax on all income including not just realized capital gains but unrealized capital gains. However the billionaire tax that Mr. President Biden Unveils Unrealized Capital Gains Tax for Billionaires.

Households worth more than 100 million as part of his. The new proposal would tax unrealized capital gains meaning that the wealthy would no longer be able to defer tax payments on gains made each year. Unrealized gains are not generally taxed.

It has already been a long year of new taxes tax hikes and even more tax proposals. The main reason you need to understand how unrealized gains work is to know how it will impact your tax bill. The Unintended Consequences Of Taxing Unrealized Capital Gains.

While the consequences of gains mean more money to invest and losses are losses understanding when to realize your capital gains and losses can give you. When including unrealized capital gains as income the households effective tax rate is 12 percent below the proposed 20 percent minimum. House Speaker Nancy Pelosi took issue with plans by fellow Democrats to levy a tax on unrealized capital gains to help pay for President Bidens 175 trillion social spending bill.

A tax on an increase in unrealized capital gains is only on the most stretched of interpretations a tax on income. The Secretary of the Treasury including any delegate of the Secretary or any other Federal Government official shall not require or impose the implementation of taxation on unrealized capital gains from any taxable asset including but not limited to. This is a very big deal.

Below are one economists estimates of what the top 10 wealthiest Americans would owe on their unrealized capital gains alone. However not all realized gains are taxed at the same rate. If the proposal were to pass billionaires.

Bidens fiscal 2023 budget request released Monday would impose a 20 minimum tax on the unrealized capital gains for households worth at least 100 millionYou cant be taxed on things. Lets try to predict the unintended consequences of a tax on unrealized capital gains by focusing on the very highest UHNWIs. Unrealized capital gains tax means if you buy a stock for 100 and it goes up to 500 then back down to 50 you owe taxes on the 400 profit you never made.

Currently the tax code stipulates that unrealized capital gains are not taxable income. Again under Bidens plan they would be required to pay a minimum 20 income tax on this appreciation. In reality it is a tax on wealth.

Many of the highest earners in the US including Elon Musk Jeff Bezos Larry Ellison and others have. The plan will be included in the Democrats US 2 trillion reconciliation bill. Unrealized capital gains tax bill.

How To Pay 0 Tax On Capital Gains Income Greenbush Financial Group

Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step Up In Basis Among Others

What S In Biden S Capital Gains Tax Plan Smartasset

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

The 2022 Capital Gains Tax Rate Thresholds Are Out What Rate Will You Pay

Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step Up In Basis Among Others

How Much Does A Comprehensive Financial Plan Actually Cost Https Www Kitces Com Blog Average Financial Plan Fee H How To Plan Financial Planning Financial

Reforming Federal Capital Gains Taxes Would Benefit States Too Itep

Tax Strategies Using Nua For Modestly Appreciated Stock

High Class Problem Large Realized Capital Gains Montag Wealth

Quicken2017 New Features Ableton Live Investing Accounting Software

12 Ways To Beat Capital Gains Tax In The Age Of Trump

Possible Changes Coming To Tax On Capital Gains In Canada Smythe Llp Chartered Professional Accountants

Bitcoin Gains Can Become Tax Free Investing In Cryptocurrency Cryptocurrency Bitcoin

I Chose This Image To Represent Management Operating Agreements This Image Displays That An External Management Compan Management Company Incentive Management

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)